Comprehensive Guide To Filing Your Annual Report With The Arizona Corporation Commission

Submitting an annual report to the Arizona Corporation Commission (ACC) is a critical responsibility for businesses operating in the state. This mandatory requirement ensures entities comply with Arizona's regulations and maintain transparency with the public. Failure to file could lead to penalties, including fines or even business dissolution. Understanding the steps involved in this process is essential for every business owner.

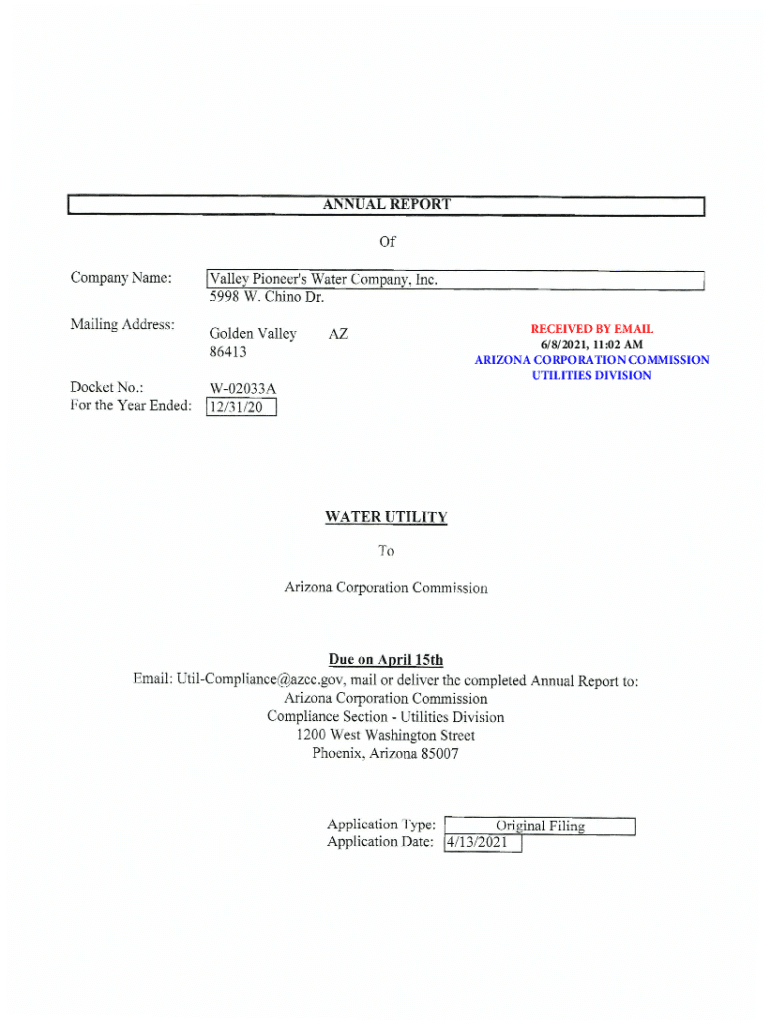

Each year, the Arizona Corporation Commission mandates corporations, limited liability companies (LLCs), and other business entities to file their annual reports. This report acts as a formal declaration of a company's status, offering essential information about its operations, structure, and regulatory compliance. By adhering to these requirements, businesses contribute to fostering a fair and transparent economic environment in Arizona.

This guide aims to provide an in-depth overview of the annual report filing process with the ACC. Whether you're a new business owner or an experienced entrepreneur, this article will walk you through every step, ensuring your company remains compliant and avoids unnecessary complications. Let's delve into the specifics of what you need to know.

Read also:Discover The Power Of Butter Sugar Coffee A Comprehensive Guide

Table of Contents

- The Importance of Filing an Annual Report

- Who Must File an Annual Report?

- The Annual Report Filing Process

- Fees Associated with Filing

- Annual Report Filing Deadline

- Consequences of Not Filing

- Steps for Online Filing

- Steps for Paper Filing

- Common Mistakes to Avoid

- Tips for a Successful Filing

Understanding the Significance of Filing an Annual Report

Filing an annual report with the Arizona Corporation Commission is more than just a formality—it's a legal obligation that ensures the integrity of your business. This document provides crucial information about your company's operations, governance, and adherence to state laws. By submitting your annual report, you demonstrate your commitment to transparency and accountability, which are essential for maintaining public trust.

Why Compliance is Essential

Compliance with the ACC's regulations is vital for several reasons:

- It guarantees your business remains active and maintains good standing with the state.

- It safeguards your company's legal status and rights.

- It offers valuable insights to stakeholders, including investors and customers.

- It prevents unnecessary fines and penalties that could harm your business financially.

In summary, the annual report filing process serves as a foundation for responsible business management in Arizona.

Which Businesses Are Required to File an Annual Report?

Not all businesses are obligated to file an annual report with the Arizona Corporation Commission. This requirement applies to specific types of entities, including:

- Corporations (both for-profit and nonprofit)

- Limited Liability Companies (LLCs)

- Limited Partnerships (LPs)

- Registered Limited Liability Partnerships (RLLPs)

It's important to note that sole proprietorships and general partnerships are exempt from this requirement. However, if your business falls under any of the categories listed above, it is imperative to ensure timely submission of your annual report.

Exceptions and Special Circumstances

While most business entities must file an annual report, certain circumstances may exempt a business from this obligation. For example, foreign entities that are not actively conducting business in Arizona may not need to file. Nonetheless, it's always advisable to consult with a legal professional or the ACC to confirm your obligations.

Read also:Exploring The Remarkable World Of Ts Luana A Digital Content Creator Extraordinaire

Navigating the Annual Report Filing Process

The process of filing an annual report with the Arizona Corporation Commission involves several key steps. Whether you opt for online or paper filing, understanding these steps is crucial for a successful submission.

Step-by-Step Instructions

Here's a detailed breakdown of the filing process:

- Verify your business's information, including registered agent details and principal office address.

- Gather the necessary documentation, such as your Employer Identification Number (EIN) and any other relevant details.

- Select your filing method—online or paper—and follow the specific instructions for each.

- Carefully review your submission to ensure all information is accurate and complete.

- Submit your report and retain a copy for your records.

By following these steps, you can ensure a seamless and error-free filing process.

Understanding the Fees Involved in Filing

There are fees associated with filing an annual report with the Arizona Corporation Commission. These fees vary depending on the type of entity and the filing method chosen. As of the latest update, the standard fees are as follows:

- Corporations: $50 (online) or $60 (paper)

- LLCs: $50 (online) or $60 (paper)

- LPs and RLLPs: $50 (online) or $60 (paper)

It's important to note that late filings may incur additional penalties, so submitting your report on time is essential to avoid extra costs.

Payment Options

The ACC accepts various payment methods, including credit cards, debit cards, and electronic checks. Ensure you have the necessary payment details ready before beginning the filing process.

Annual Report Filing Deadline

The deadline for filing an annual report with the Arizona Corporation Commission is typically May 1st of each year. However, the exact deadline may vary depending on the type of entity and its formation date. For instance, corporations formed in the latter half of the year may have a later deadline for their first filing.

What Happens if You Miss the Deadline?

Missing the annual report filing deadline can result in penalties, including late fees and potential suspension of your business's active status. To avoid these consequences, it's crucial to submit your report by the specified deadline.

The Impact of Failing to File

Not filing an annual report with the Arizona Corporation Commission can have severe repercussions for your business. These include:

- Financial penalties, such as late fees and reinstatement costs.

- Loss of good standing status, which can hinder your ability to conduct business in Arizona.

- Possible dissolution of your business entity by the state.

These consequences underscore the importance of adhering to the ACC's requirements.

How to Prevent Penalties

To avoid penalties, ensure you keep track of your filing deadlines and submit your annual report on time. Setting reminders or collaborating with a professional service can help ensure you never miss a deadline.

How to File Online

Online filing is the most convenient and efficient way to submit your annual report with the Arizona Corporation Commission. Here's how you can do it:

Step-by-Step Instructions

- Visit the Arizona Corporation Commission website.

- Log in to your account or create a new one if necessary.

- Select the "Annual Report Filing" option and follow the prompts.

- Enter your business's information and carefully review it for accuracy.

- Submit your payment and confirm your submission.

Online filing not only saves time but also reduces the risk of errors, making it the preferred method for most businesses.

How to File via Paper

While online filing is recommended, some businesses may prefer or need to file their annual report via paper. Here's how you can do it:

Step-by-Step Instructions

- Download the appropriate annual report form from the ACC website.

- Complete the form accurately and legibly, ensuring all required fields are filled out.

- Attach any necessary supporting documents, such as proof of payment.

- Mail the completed form and payment to the ACC's address, as specified on their website.

Paper filing may take longer to process, so plan accordingly to ensure your report is received before the deadline.

Avoiding Common Errors in the Filing Process

Even the most diligent business owners can make mistakes when filing their annual report. Here are some common errors to watch out for:

- Submitting incomplete or inaccurate information.

- Missing the filing deadline due to poor planning.

- Overlooking required attachments or documentation.

- Using outdated forms or following incorrect instructions.

By being aware of these potential pitfalls, you can take proactive steps to avoid them and ensure a successful filing.

How to Thoroughly Review Your Submission

Before submitting your annual report, review it meticulously to ensure all information is accurate and complete. Consider having a colleague or professional review it as well to catch any potential errors.

Strategies for a Successful Filing

To make the annual report filing process as smooth as possible, consider the following strategies:

- Start preparing early to avoid last-minute stress.

- Keep all necessary documents and information easily accessible.

- Utilize the ACC's online resources and FAQs for guidance.

- Consider working with a professional service if you're unsure about any aspect of the process.

By following these strategies, you can ensure a stress-free and successful filing experience.

Final Thoughts

Filing an annual report with the Arizona Corporation Commission is a crucial responsibility for businesses operating in the state. By understanding the process, deadlines, and potential consequences of non-compliance, you can ensure your company remains in good standing and avoids unnecessary complications. Remember to stay organized, plan ahead, and seek professional assistance if needed.

Kesimpulan

Submitting your annual report to the Arizona Corporation Commission is a vital step in maintaining your business's compliance and good standing. This comprehensive guide has covered everything you need to know, from the importance of filing to the specific steps involved in the process. By following the advice provided, you can ensure a successful and error-free submission.

We encourage you to take action today by starting your annual report preparation. Share this article with fellow business owners or leave a comment below if you have any questions or additional tips to share. For more helpful resources, explore our other articles on business compliance and management.